sacramento property tax rate 2020

075 to city or county operations. Revenue and Taxation Code Section 72031 Operative 7104 Total.

Sacramento California Ca Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Sacramento county 2019-2020 compilation of tax rates by code area code area 03-017 code area 03-018 code area 03-019 county wide 1 10000 county wide 1 10000 county wide 1.

. Primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton city of 1 03 sacramento city of 1 04. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. View the E-Prop-Tax page for more information.

View the Boats and Aircraft web pages for more information. Sacramento property tax rate 2020 Thursday September 8 2022 Edit. As we stated previously California.

For comparison the median home value in Sacramento County is. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Sacramento County collects on average 068 of a propertys.

075 lower than the maximum sales tax in CA. This tax is charged on all NON-Exempt real property transfers that take place in the City limits. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes.

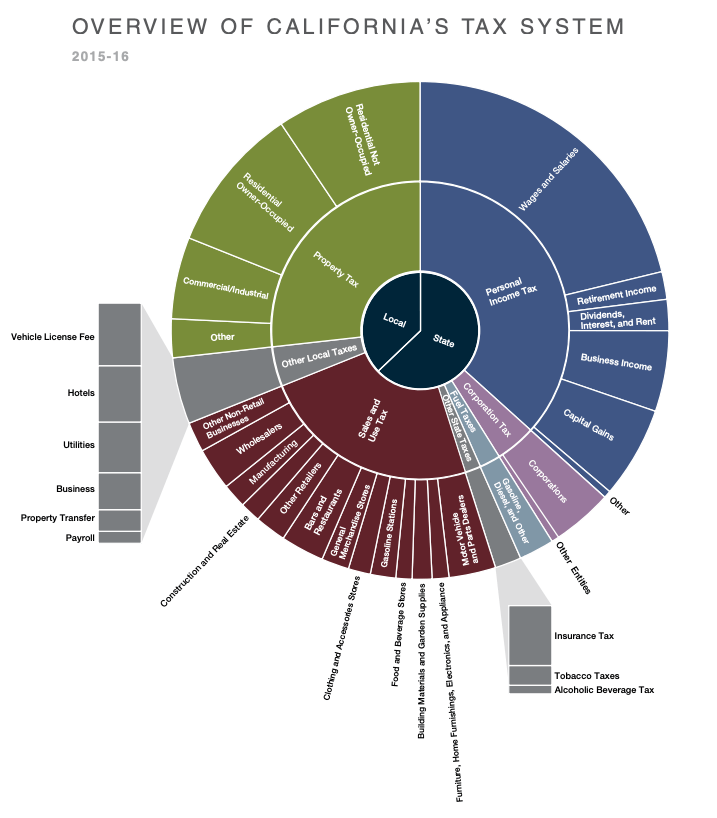

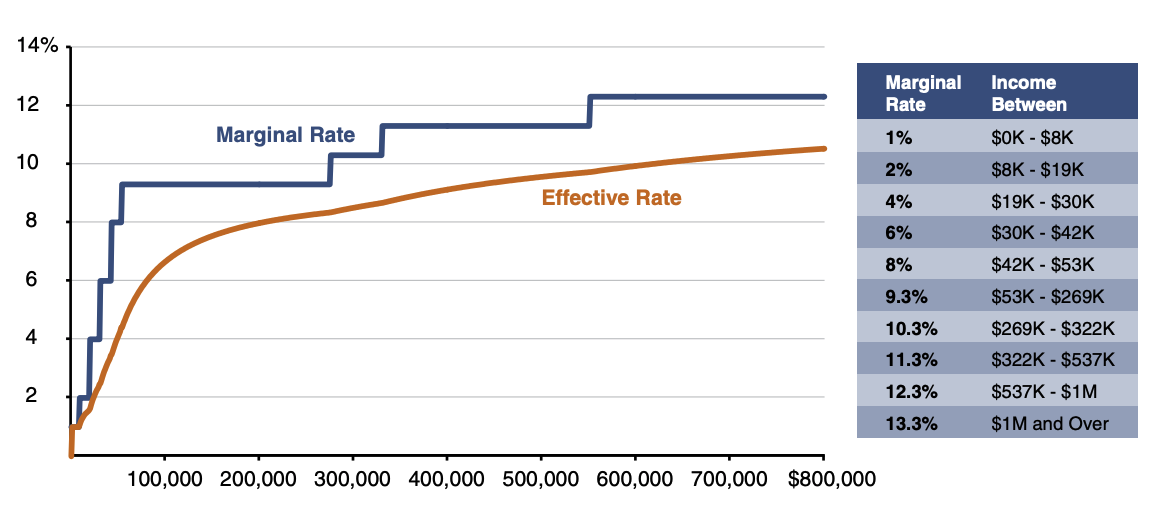

Online videos and Live Webinars are available in lieu of in-person classes. Property taxes are a one-percent tax on a propertys assessed value under California law After the deduction of property tax exemptions for homeowners disabled veterans and charitable. Comparing Property Tax Rates In California Counties.

A comparison of 2020 tax rates compiled by the Tax Foundation ranks. Privately and commercially-owned boats and aircraft are also subject to personal property taxes. Two Family - 2 Single Family Units.

Sacramento county tax rate area reference by primary tax rate area. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. Total tax rate Property tax.

What is the highest tax rate in California. Paying your taxes through an online service or a credit card can also be used. The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025 Sacramento County sales tax 1 Sacramento tax and.

Sacramento County The countys average effective property tax rate is 081. If you value your property at 200000 and the property tax rate is 81 then the total property tax on the property would be 1620 per year. For questions about filing extensions tax relief and more call.

Sacramento County Property Tax Anderson Business Advisors Property Tax Calculator Prop. Lowest property tax rate for your home. Permits and Taxes facilitates the collection of this fee.

They can be reached Monday -. 025 to county transportation funds. The property tax rate in the county is 078.

Two Family - 2 Single Family Units. The median property tax also known as real estate tax in Sacramento County is 220400 per year based on a median home value of 32420000 and a.

California 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Politifact No Californians Aren T Being Asked To Repeal Prop 13 S Residential Property Tax Limits

Prop 19 Would Make Changes To California S Residential Property Tax System California Budget And Policy Center

Sacramento County Housing Indicators Firsttuesday Journal

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

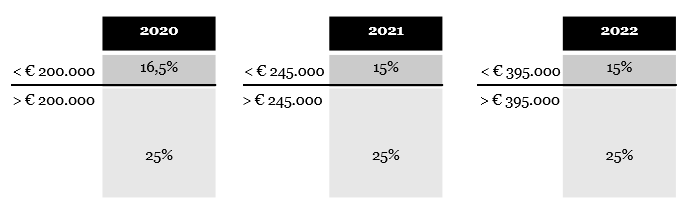

Dutch 2021 Tax Bill And Real Estate In The Netherlands Insights Greenberg Traurig Llp

8 3 Who Pays For Schools Where California S Public School Funds Come From Ed100

2021 22 Sacramento County Property Assessment Roll Tops 199 Billion

Alabama Property Tax H R Block

About Proposition 19 2020 Ccsf Office Of Assessor Recorder

2022 Property Taxes By State Report Propertyshark

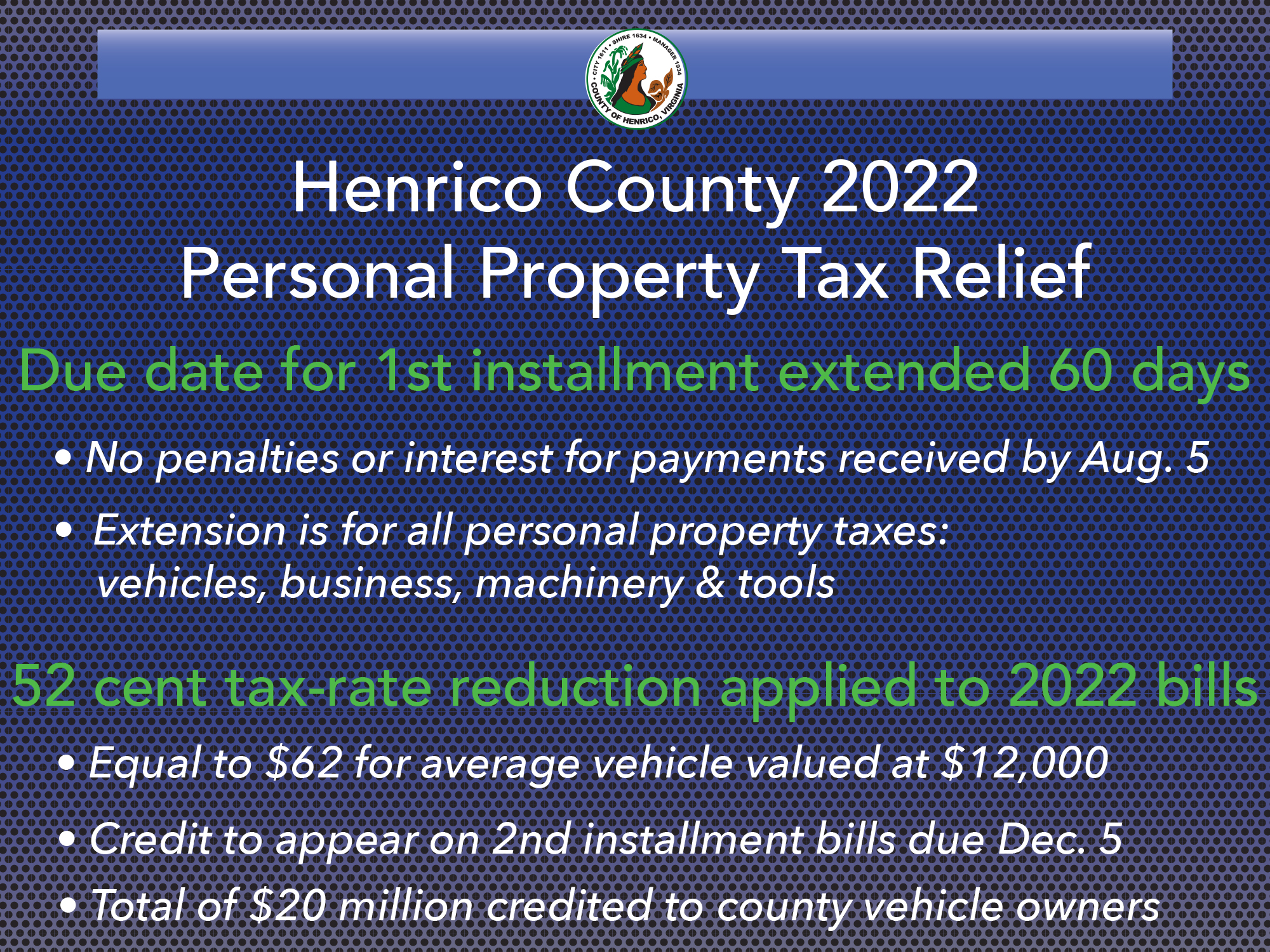

Henrico Proposes Personal Property Tax Relief To Offset Rising Vehicle Values Henrico County Virginia

Connecticut Property Tax Limitations What Ct Can Learn From Neighbors

California Property Tax Calculator Smartasset

Understanding Inequitable Taxes On Commercial Properties And Prop 15 California Budget And Policy Center

Sacramento County California Ballot Measures Ballotpedia

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

2022 Property Tax Rates Austin Tx Virtuance Real Estate Photography

Orange County Ca Property Tax Search And Records Propertyshark